Net Worth Certificate for DEMAT

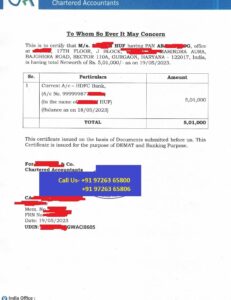

Looking for Net Worth Certificate for DEMAT? If Yes, You are at right place. We Provide Chartered Accountant (CA) Certified Net Worth Certificate for DEMAT and Trading Account Purpose. Get CA Net Worth Certificate for Personal Account, Partnership Firm or LLP or Company etc.

Get in One Hour – Connect Now

Interested in Net Worth Certificate for Investment?

Why Net Worth Certificate Required While We Open DEMAT Account?

When We Want to Open DEMAT Account or Trading Facility in some kind of risk based investment category then Broker/Depository May ask for Net Worth Certificate of Account Holder. Such kind of DEMAT Account can be open for any person, Company, Partnership Firm or LLP etc. Generally High Risk Investments, Future and Options (Derivative) Products, P2P, Opening of Margin Trading Facilities required to furnish Net Worth Certificate.

Thus, Purpose is to check whether account holder have sufficient wealth to take such kind of risk or not. Contact us for Net Worth Certificate Service, We Serves DEMAT Purpose CA Certificate With UDIN of CA Delivering Across India.

What Kind of Trading Facilities Generally Required Net Worth Certificate?

Let’s Check Which Kind of DEMAT Facilities required CA Wealth Certificate and What is purpose behind it.

- Margin Trading Facility: Generally this types of trading required Wealth Certificate as Broker allow Trader to buy Stock with only margin amount. Net Worth Certificate assures broker that trader will make inflow of cash in adverse situation.

- Investment Limits Criteria: As per type of Investment sometime Issuer or Broker required Assets Valuation Certificate to ascertain the class of Investor. (Eg. P2P Finance Investment etc)

- Regulatory Requirement: As per SEBI Guidelines on Customer/Account Holder KYC Norms (Know Your Customer), Net Worth Certificate is Essential part of KYC for Person, Partnership Firm, Company or LLP etc. This Assures Financial Strength of Investor to engage in Investment and Trading.

- Risk Assessment : Portfolio Manager and Broker Will Ask for CA Net Worth Certificate to check risk taking capacity of Client. According to that Broker can set limit of Trades, F&O Activation etc.

- Fraud Prevention and Due Diligence: To Prevent from unauthorized trading, or to stop from trades where possibility of non fulfillment may arise from client side. Thus, Overall prevention from fraudulent transactions.

- Derivatives: Future and Options (F&O) Activation requires Net Worth Certificate of Trader.

- Accounting Opening of Separate Entity: Separate Legal Entities Like Partnership Firm, LLP, Private Limited Company DEMAT Account Requires Net Worth Certificate of Firm or Company.

Documents Required for Net Worth Certificate for DEMAT

Following Documents Required for Preparation of Chartered Accountants Net Worth Certificate for Partnership Firm, LLP, Trust, HUF or Company, Private Limited Company.

- PAN Card

- Latest Bank Account Statement of Company/Firm

- If Private Limited Company or LLP (Incorporation Certificate)

- If Partnership Firm (Partnership Deed)

- Optional/only if applicable (Last Balance Sheet of Company)

(For Personal/Individual’s Certificate Document CheckList click here)

Charges of DEMAT Purpose Net Worth Certificate by CA

DEMAT Purpose CA Certificate with UDIN Charges are Rs. 2000/- (Inclusive all)